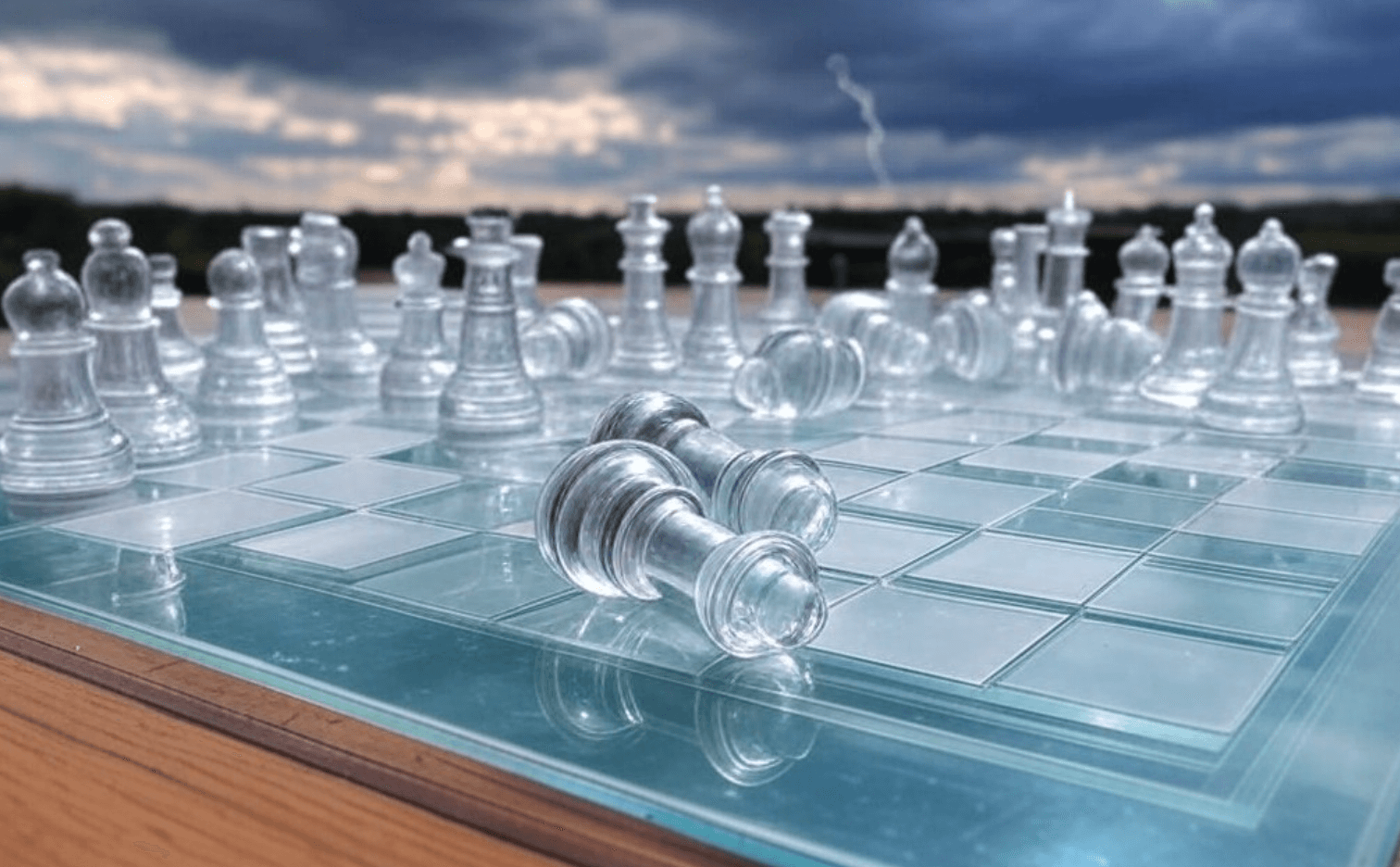

The Fragility of Perceived Control In Stock Markets

Guessing Or Betting On Random Number Generators

There is a fragility of perceived control in the stock market. Some people – mostly the very wealthy – have this notion that they are masters of the universe. On the other hand, retail traders feel like they are only at the whims of the elite.

The stock market often feels like a game of chance—a vast, complex system that seems to operate beyond the grasp of most participants. Retail investors often believe they are at the mercy of institutional investors, hedge funds, and algorithmic trading systems that supposedly hold all the power. This belief creates a sense of learned helplessness, where retail investors resign themselves to a passive role, convinced that their actions can’t make a meaningful difference in the face of such overwhelming forces.

But here’s the irony: the perceived control that institutional investors and hedge funds believe they have is far more fragile than it appears. And retail investors, despite their limitations, possess an agility that institutions often lack. The stock market, at its core, behaves like a Random Number Generator (RNG)—a system capable of generating countless outcomes within a set of constraints. Understanding the fragility of this control and the dynamics of the system can empower both individual and institutional participants to see the market for what it truly is: a bounded yet unpredictable environment where no one is entirely in control.

The Stock Market as a Constrained RNG

The stock market behaves like a Random Number Generator: it produces seemingly infinite outcomes that appear random, but all within a framework of rules, constraints, and external conditions. These constraints include:

- Regulations: Circuit breakers, the uptick rule, and disclosure requirements are designed to stabilize the system and prevent extreme volatility.

- Scale and Complexity: The sheer number of stocks, trades, and global factors influencing the market creates layers of unpredictability.

- Human and Algorithmic Behavior: Collective psychology and algorithmic trading amplify trends, introducing patterns that often feel random but are shaped by behavioral feedback loops.

While these constraints create boundaries, the outcomes remain effectively unpredictable within those limits. No participant—retail or institutional—has complete control, no matter how much influence they might appear to wield.

The Illusion of Institutional Control

Institutional investors and hedge funds are often seen as the ultimate market movers, with their algorithms, resources, and massive capital flows. And to a large extent, they do shape market trends. But their influence is far more constrained than many realize:

- Regulation: Institutions operate under strict regulatory oversight, from fiduciary responsibilities to compliance requirements, which slow their ability to pivot quickly or take aggressive risks.

- Scale: Large institutions cannot execute trades with the same speed or flexibility as retail investors. Moving billions of dollars without disrupting prices or alerting competitors is a logistical challenge.

- Systemic Vulnerability: Algorithms and institutional strategies are built on predictable patterns, but those patterns can break down under unexpected conditions, such as black swan events or shifts in collective sentiment.

In short, the perceived control institutions have is fragile, dependent on the conditions of the market staying relatively stable. When external shocks occur, they are often slower to respond than retail investors due to their size and the layers of regulation they must navigate.

The Power—and Risk—of Retail Investors

Retail investors, on the other hand, often feel powerless in the face of institutional dominance. This learned helplessness stems from a belief that the market is rigged in favor of the “big players.” But retail investors have something institutions don’t: speed and agility.

- Speed of Action:

- Retail investors can move quickly, buying or selling at a moment’s notice without the bureaucratic hurdles institutions face. This gives them the ability to act on short-term trends or unexpected market movements before larger players can adjust.

- At the same time, given the lack of leverage over market makers, retail traders can routinely get locked out of their accounts. Many instances during the meme stock boom of the last few years have demonstrated how dangerous this can be.

- Flexibility:

- With smaller amounts of capital at stake, retail investors can take positions in niche opportunities that would be too small to matter for institutions. This creates room for creative strategies that are impossible at institutional scales.

- Risk of Overtrading:

- However, this speed can also be a hindrance. Retail investors, without clear strategies, often fall into the trap of overtrading, chasing gains, or gambling on speculative opportunities. This behavior, driven by emotion rather than discipline, can turn their advantage into a liability.

The power of retail investors lies in their ability to act decisively and independently. But to truly capitalize on this, they must overcome the learned helplessness that keeps them from recognizing their own potential.

The Fragility of Market Control

Both institutional and retail investors operate within a market that is, at its core, unpredictable. The constraints and dynamics that shape the market create a system where no one is fully in control:

- Institutional investors wield immense power, but their size, regulations, and reliance on predictable patterns limit their flexibility.

- Retail investors have agility and independence, but their emotional tendencies and lack of coordinated action often undermine their potential.

This shared fragility highlights the true nature of the market: a system that behaves like an RNG, producing outcomes that are random within defined limits but shaped by the interactions of its participants. The market’s “control” is an illusion, constantly vulnerable to external shocks, collective behavior, and shifts in the environment.

Embracing the Market’s Chaos

Understanding the stock market as a constrained RNG can help both retail and institutional investors navigate its complexities:

- For Retail Investors: Recognize your agility as an advantage, but avoid turning it into a weakness by overtrading or acting impulsively. Learn to leverage your independence to focus on opportunities that larger players can’t pursue.

- For Institutions: Acknowledge the limits of your control and the fragility of your influence. Build systems that are resilient to shocks and adaptable to changes in market conditions.

- For Everyone: Accept that no one has absolute control over the market. By understanding the dynamics of the system—its constraints, behaviors, and unpredictability—you can position yourself to act strategically within its bounds.

It’s Not A Casino, It’s More Like A Pool Hall Now

The stock market often gets compared to a casino. Especially in online trading communities, people refer to options trading or speculative investing as “gambling,” emphasizing chance over skill and painting a picture of retail traders up against an unbeatable “house.” The mindset this creates is both disempowering and toxic: you either win big by luck or lose everything because the game is rigged.

But here’s the thing—the market isn’t a casino. It’s not a system where you’re perpetually at the mercy of randomness or the “house.” If anything, the stock market is more like a pool hall—a place where skill plays the dominant role, but the potential for chance and hustling always lingers in the background. Unlike casino games, where randomness is baked into the rules, the stock market rewards strategy, observation, and adaptability, much like a competitive game of pool.

The stock market isn’t a game of pure chance, but it’s also far from being fully controlled. It behaves like a constrained Random Number Generator, producing countless outcomes within defined parameters, shaped by human and algorithmic inputs. The perceived control of institutional investors is fragile, limited by scale and regulation, while the learned helplessness of retail investors hides their true potential to act swiftly and independently.

The market is neither fully random nor entirely structured—it’s a system where fragility and unpredictability coexist. Understanding this balance can help you navigate its chaos and recognize your role within it.

The Stock Market Is Like Sports – A Metaphor

Many people view the stock market like sports—they see themselves as spectators, betting on outcomes rather than participating in the game itself. Options are often treated like parlays, with traders packaging bets on various outcomes, and market conversations resemble the chatter around prop bets: speculating on specific moves, “game day” earnings reports, or breaking news.

The problem with this mindset is that it keeps investors passive, focusing on what others (institutions, executives, or algorithms) are doing rather than seeing themselves as active participants. They act like fans in the stands, not realizing they can step onto the field—or even influence the game as a coach, a player, or an owner.

My approach to the market is entirely different. When I buy into a company, I see myself as an owner, not a spectator. That means thinking beyond price movements or short-term speculation and asking how I can contribute to the company’s success. Whether that’s supporting their products, advocating for the brand, or understanding their strategy, my investment isn’t just a bet—it’s participation in the game itself. This active mentality shifts the focus from predicting outcomes to shaping them.

Recovering From Learned Helplessness

This begins with rejecting the role of a passive observer and embracing your capacity to actively influence outcomes. Whether it’s reframing your mindset to see yourself as an owner, sharpening your skills to master the nuances of the game, or understanding the dynamics of the system you’re part of, the path forward is about reclaiming agency. The market isn’t a casino or a game meant only for spectators—it’s a pool hall where skill, strategy, and participation determine success.

The question is whether you’re ready to step up, take control, and start shaping the game instead of watching from the sidelines.